The Lithium Mining Market

Discover the booming lithium market driven by EVs and renewable energy as demand surges and supply chains evolve.

Introduction

Global demand for lithium, the lightest metal on Earth, has grown rapidly in recent years. As the world shifts toward renewable energy and works to cut carbon emissions, demand for lithium-ion batteries in electric vehicles (EVs) and energy storage systems has skyrocketed.

In this blog post, we’ll explore the lithium market - from where it’s found and how it’s extracted to its key applications and the forces driving its growth.

Table of contents:

- The World is Racing Against a Lithium Shortage

- Geographical Distribution and Sources

- Applications and Market Segments for Lithium

- Lithium Compounds in the Market

- Different Lithium Battery Types

- Gigafactory Growth Exposes the Lithium Bottleneck

- Battery Manufacturing Booms - But Lithium Supply Must Keep Up

- Key Market Drivers of the Lithium Mining Industry

- Governments and Regulations - Steering the Future of Clean Energy

- Industry Outlook and Predictions

- Diverse Technologies for Lithium Extraction

- Technological Benchmark

- The Urgent Need for Sustainable Lithium Extraction

The World is Racing Against a Lithium Shortage

As the world accelerates its shift toward green energy, lithium has become a critical mineral driving that transformation. Central to rechargeable battery technology, lithium fuels innovation in energy storage and electric mobility, making it essential in the push toward a more sustainable, decarbonized future.

As countries work to cut emissions and electrify their infrastructure, lithium plays a vital role in making this possible. From electric vehicles (EVs) to large-scale renewable energy storage, it's the foundation for the technologies powering the transition to a cleaner world.

A Surge in Lithium Demand: Can Supply Keep Up?

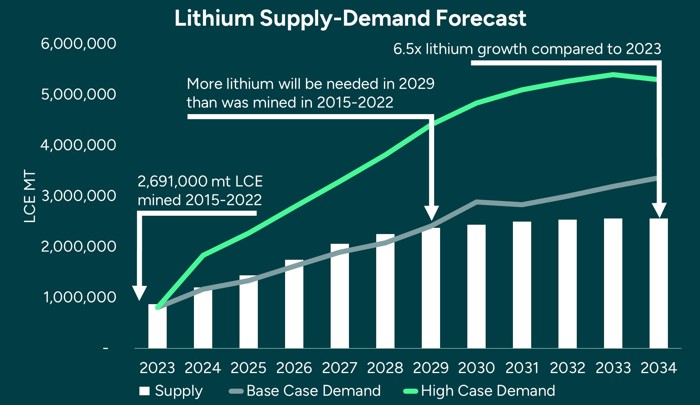

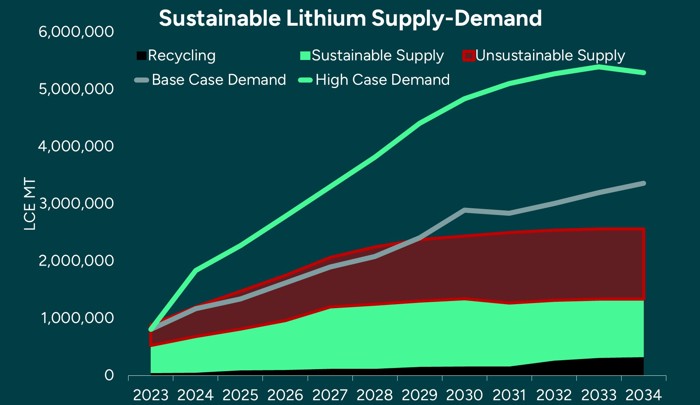

The demand for lithium is rising at an unprecedented pace. Between 2023 and 2030, global lithium demand is projected to increase 3.5 times, primarily driven by the rapid adoption of electric vehicles (EVs) and the expanding use of lithium-ion batteries. This surge reflects the transition to electrification across multiple sectors as businesses and governments embrace greener energy solutions.

Despite production increases, the industry is nearing a serious supply shortfall. By 2029, global demand could exceed supply, requiring more lithium in a single year than was mined worldwide between 2015 and 2022.

The Looming Lithium Shortage: A Race Against Time

The potential supply gap looms large. Projections indicate that by 2034, global demand for lithium could be 6.5 times greater than in 2023, further widening the supply-demand imbalance. By 2029, the industry may reach a tipping point where demand outstrips supply, creating significant challenges for the global energy transition. This impending shortage highlights the critical need for innovative, scalable, and environmentally responsible methods to extract lithium to meet future demand.

Insights from CERAWeek 2025

Lithium demand is surging - are we ready for what comes next? Sune Mathiesen on the growing supply gap.

At CERAWeek 2025, our CEO, Sune Mathiesen, joined the global conversation on the urgent need for scalable lithium solutions. In this short video, he explains the accelerating demand, the looming supply gap, and why traditional mining methods won't be enough to meet future needs.

Geographical Distribution and Sources

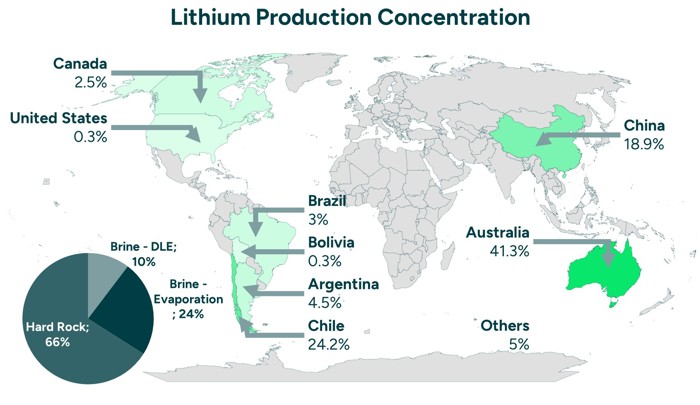

Today, approximately 90% of the world’s lithium production is concentrated in just four countries: Australia, Chile, China, and Argentina. Australia is currently the largest lithium producer, contributing over 40% of global lithium output in 2023, primarily through the extraction of spodumene ore. Despite Australia’s mining dominance, China processes most of Australia’s lithium ore, refining it into battery-grade products and ultimately controlling a significant portion of the global lithium supply chain.

Lithium Sources

As of 2024, 66% of lithium production comes from ore mining, while 34% is from brine extraction (10% DLE and 24% evaporation). Australia’s production relies heavily on hard rock mining, which involves extracting spodumene ore, while countries like Chile and Argentina utilize their vast continental brine reserves to extract lithium.

This geographical distinction highlights the diversity in extraction methods across regions. In South America, brine operations dominate, while ore mining is the leading method in Australia.

U.S. Lithium Production

The U.S. was once a major lithium producer, supplying 27% of global lithium back in 1996. But by 2023, its share had fallen to under 1%. This steep drop has raised concerns among policymakers, especially with the passage of the 2022 Inflation Reduction Act, which underscores the need to boost domestic lithium production.

A reliable lithium supply is essential for energy security, EV growth, and renewable storage. For the U.S., becoming more self-sufficient is now a strategic priority.

Applications and Market Segments for Lithium

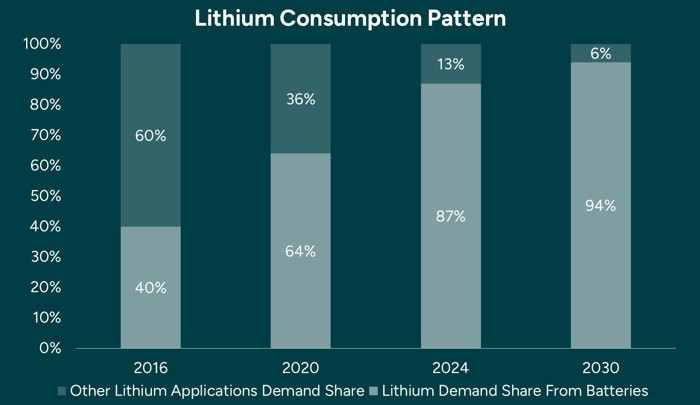

In recent years, lithium has become indispensable in a wide range of industries, including batteries, ceramics, glass, lubricating greases, air treatment systems, and casting powders. But lithium’s most significant growth driver is its use in batteries, especially for electric vehicles (EVs), consumer electronics, and energy storage systems.

By 2024, batteries accounted for 87% of total lithium consumption, up from 40% in 2016. This dramatic shift is primarily driven by the explosive growth of the electric vehicle (EV) market, where rechargeable lithium-ion batteries have become the standard due to their lightweight design and high energy density. Since 2016, global lithium consumption has nearly tripled, with batteries fueling most of that growth.

Lithium’s unique properties make it ideal for modern battery technology. It’s lightweight, energy-dense, and offers a long cycle life, making it the go-to material for powering electric vehicles (EVs) and other high-performance systems. And demand is only set to climb: By 2030, batteries are expected to account for 94% of global lithium use, with all other applications making up just 6%.

Evolution of Lithium Demand

The evolution of lithium demand tells a clear story - batteries have become the dominant driver of growth. This rapid shift highlights lithium’s critical role in electrifying transportation and enabling clean energy storage. As the push to decarbonize intensifies, lithium’s role in powering the green energy revolution is more secure than ever.

Lithium Compounds in the Market

Today, the two most commonly used lithium compounds are lithium carbonate and lithium hydroxide, both of which are essential for battery production.

Lithium carbonate is the primary compound used to manufacture materials for lithium-ion batteries, making it the dominant player in the market.

Lithium hydroxide, meanwhile, is gaining importance as NMC (nickel-manganese-cobalt) batteries capture a larger share of the electric vehicle (EV) market. These batteries offer higher energy density and better performance, particularly for electric vehicles, which has driven up demand for lithium hydroxide.

In addition to these key compounds, spodumene concentrate is widely used as a feedstock for producing both lithium carbonate and hydroxide. Lithium chloride also plays a role, although to a lesser extent, particularly in specific niche applications such as air treatment and lubricating greases.

Usage |

|

|---|---|

| Lithium carbonate | Widely used in lithium-ion batteries and pharmaceuticals. |

| Lithium hydroxide | Important for battery production, ceramics, and lubricants. |

| Lithium chloride | Utilized in air conditioning systems and as a catalyst in organic synthesis. |

| Butyllithium | An organolithium compound used in chemical reactions and as a polymerization initiator. |

| Lithium metal | Valuable for specialized applications, including lithium batteries and alloys. |

Usage

Different Lithium Battery Types

A variety of lithium-ion battery chemistries are fueling growing demand. Currently, six main types of lithium-ion batteries are commercially available, each designed to meet specific performance, safety, and application needs.

Main application |

Materials used |

Advantages |

|

|---|---|---|---|

| The Nickel Manganese Cobalt (NMC) | EV batteries, consumer electronics, energy storage | Lithium hydroxide/Lithium carbonate nickel, manganese, and cobalt | Higher energy density and faster charging performance in cold climates |

| Lithium Nickel Cobalt Aluminum oxides (NCA) | EV batteries | Lithium hydroxide, nickel, cobalt, aluminum | Higher energy density |

| Lithium Iron Phosphate (LFP) | EV and mobility batteries, energy storage | Lithium carbonate, iron, phosphorus | Longer life cycle, less thermal runaway risk and lower cost |

| Lithium Cobalt Oxide (LCO) | Smartphones, tablets, laptops, cameras and other handheld devices | Lithium carbonate, cobalt | High energy density, impressive cycle life, and reliability |

| Lithium Manganese Oxide (LMO) | Power tools, e-bikes, minimal EV applications | Lithium carbonate, manganese | Lower internal resistance and improved current handling. High thermal stability and enhanced safety |

| Lithium titanate (LTO) | Energy storage, industrial tools, electrical power trains | Lithium carbonate, titanium | Good thermal stability under high temperature |

Main application

Materials used

Advantages

Gigafactory Growth Exposes the Lithium Bottleneck

As the world accelerates toward electrification, the rapid expansion of battery gigafactories is essential to meet surging demand for electric vehicles (EVs) and renewable energy storage. But this impressive growth also exposes a critical challenge: a looming lithium shortage - the key ingredient powering lithium-ion batteries.

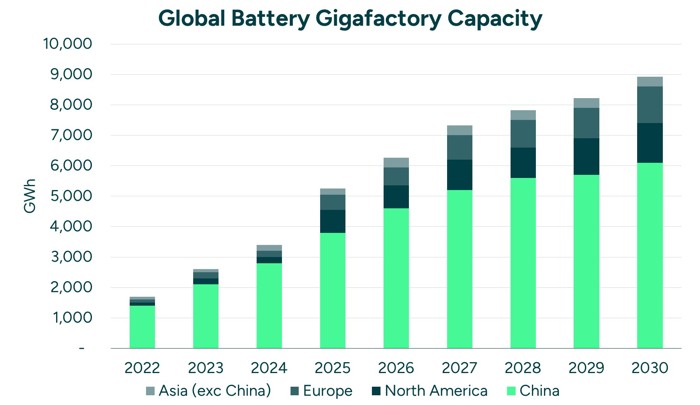

According to insights from Benchmark's Lithium-ion Battery Database and Lithium Forecast, the projected lithium supply in 2024 is expected to support the production of around 3,200 GWh of lithium-ion batteries. While that may sound substantial, the picture becomes more concerning when we look ahead. By 2030, if all announced gigafactories come online as planned, only 36% of global production capacity will be usable without significant investment in lithium supply chains.

This is where the bottleneck becomes clear: lithium supply is now the limiting factor in scaling up battery production. The growing gap between gigafactory capacity and available lithium threatens to slow the global energy transition and poses a significant challenge for the EV and clean energy industries.

Battery Manufacturing Booms - But Lithium Supply Must Keep Up

Global demand for lithium - a critical material in battery production - is surging like never before. This rapid growth is primarily fueled by the rise of electric vehicles (EVs), which is bolstered by significant legislative efforts, such as the Inflation Reduction Act in the U.S. and the European Critical Raw Materials Act. These policies are reshaping the energy and automotive sectors, accelerating the development of EV supply chains worldwide. (Learn more in the section below: "Government & Regulations")

In 2025, the total U.S. battery manufacturing capacity is expected to reach a staggering 440 GWh, a significant increase from the current production capacity of 119 GWh. By 2030, this figure is projected to surpass 1,000 GWh, marking a more than 9x increase and signaling the country's deepening commitment to clean energy.

Plans for approximately 47 new gigafactories across the U.S. are driving this expansion. Together, they are expected to exceed 1,039 GWh in capacity by 2030. However, this kind of growth comes with enormous resource demands: an estimated 760,000 metric tons of Lithium Carbonate Equivalent (LCE) will be needed to support battery production in the United States alone.

Europe is keeping pace. With over 47 gigafactories planned, the continent is on track to produce nearly 1,200 GWh of battery capacity by 2030 - up from around 100 GWh today. To power this growth, Europe will require almost 880,000 metric tons of LCE, reflecting a significant investment in clean energy infrastructure and a clear push to reduce carbon emissions.

Key Market Drivers of the Lithium Mining Industry

The lithium mining industry is experiencing rapid growth, fueled by several major forces reshaping global markets. As the push for clean energy and electric vehicles (EVs) accelerates, lithium - the backbone of lithium-ion batteries - has become one of the world’s most in-demand resources.

Here are the key drivers powering the expansion of the lithium mining industry:

-

Electric Vehicles – The Primary Driver of Lithium Demand

The rapid adoption of electric vehicles is the single most significant driver of lithium demand, now accounting for around 87% of the market. Governments and automakers worldwide are aggressively promoting policies and innovations to reduce carbon emissions and encourage sustainable transportation. In fact, more than 20 major car manufacturers, representing 90% of global car sales in 2023, have already set electrification targets.

As a result, EV production is booming. Global EV sales are expected to grow from 14 million units in 2023 to nearly 50 million by 2030. Lithium-ion batteries, which power these vehicles, depend on lithium for their high energy density and efficiency, making EVs a cornerstone of lithium consumption.

-

Renewable Energy Storage – Stabilizing the Grid with Lithium

As the world moves toward decarbonization, lithium is becoming essential to the rise of renewable energy. Solar and wind power are intermittent by nature, making large-scale, efficient energy storage a critical part of any clean energy strategy.

Lithium-ion batteries offer a scalable, reliable solution. They allow excess energy from renewable sources to be stored and dispatched when needed, helping to stabilize energy grids and ensure a steady power supply.

As countries work to hit their climate targets and strengthen grid resilience, the demand for lithium-powered energy storage systems is accelerating, further driving global lithium consumption.

Learn more about how lithium is powering the renewable energy revolution.

-

Battery Gigafactory Growth – Pressuring the Lithium Supply Chain

As global electrification gains momentum, scaling battery gigafactories is crucial to meeting the surge in demand for electric vehicles (EVs) and renewable energy storage. But this rapid expansion is also putting intense pressure on lithium supply chains.

Battery manufacturing capacity is expected to grow nearly ninefold in the U.S. from 2022 to 2030. In the EU, that figure jumps even higher, with a projected increase of 11.7 times. Globally, battery capacity is set to grow more than fivefold by 2030.

Yet, without significant investment in lithium extraction and processing, only about 36% of that capacity may be usable, revealing a growing gap between battery production goals and lithium supply readiness.

-

Battery Innovation – Pushing Lithium Demand Higher

Ongoing advances in battery chemistry are driving the growth of the lithium market. Next-generation lithium-ion technologies, including solid-state batteries and high-efficiency NMC (nickel, manganese, cobalt) chemistries, are raising the performance bar and driving demand for lithium compounds.

These innovations offer higher energy density, longer life cycles, and faster charging times. They are critical for scaling the EV market and electrifying other industries where performance and reliability are key.

As battery tech evolves, so does the need for more lithium - and in higher-quality forms.

-

Government Policies – Accelerating Lithium Demand

Government initiatives aimed at accelerating the clean energy transition are playing a significant role in boosting lithium demand. Policies like the Inflation Reduction Act (IRA) in the U.S. and the European Critical Raw Materials Act offer financial incentives, subsidies, and tax breaks for EV production and purchases, as well as investments in raw material sourcing, battery manufacturing, and renewable energy infrastructure.

At the same time, many governments are setting firm deadlines to phase out internal combustion engines, putting even more pressure on automakers to shift toward electric models powered by lithium.

These policy-driven pushes are helping solidify lithium’s role at the center of the energy transition.

-

Supply Chain Realignment – Strengthening Local Lithium Production

Lithium’s strategic importance is reshaping global supply chains. Countries are racing to secure domestic sources of this critical mineral, driven by growing concerns over supply chain vulnerabilities, especially the heavy reliance on China for lithium processing.

In response, nations like the U.S. and those in the European Union are investing heavily in localizing lithium production and reducing their dependence on foreign suppliers. These efforts are fueling new mining projects, lithium recycling initiatives, and the development of local processing facilities in North America, Europe, and other key regions.

Strengthening regional supply chains is now a top priority for ensuring energy security and supporting the transition to clean energy.

-

Consumer Electronics – A Steady Driver of Lithium Demand

While EVs lead the charge, consumer electronics continue to play a vital role in driving lithium demand. Lithium-ion batteries power a wide range of everyday devices, from smartphones and laptops to tablets and wearable devices.

As the consumer electronics industry grows and devices become more powerful and energy-efficient, the demand for reliable, rechargeable batteries continues to rise. This ongoing trend adds steady momentum to the overall growth of the lithium market.

-

Sustainability and Decarbonization – The Big Picture Driver

The global push toward sustainability and decarbonization is redefining the future of the lithium mining industry. As more countries commit to net-zero emissions targets, lithium has become a critical enabler of these ambitions.

From electric transportation and clean energy grids to more sustainable industrial systems, the transition depends on lithium-ion batteries. That positions lithium as a foundational element of the global green energy revolution - and cements its role in building a cleaner, more resilient future.

Governments and Regulations - Steering the Future of Clean Energy

Governments and regulatory frameworks have never been more important in shaping the future of industries like clean energy, electric vehicles (EVs), and lithium mining. As countries commit to cutting carbon emissions and transitioning to sustainable energy sources, new policies are emerging to support this global shift.

From subsidies and tax incentives to stricter environmental standards and resource security strategies, governments are using a wide range of policy tools to:

- Encourage innovation

- Support domestic production

- Strengthen critical mineral supply chains

For companies in the lithium and electric vehicle (EV) sectors, understanding and aligning with these evolving policies is crucial to long-term success in a rapidly changing market.

-

Global Net-Zero Goals – And Why Lithium Is Essential

A growing coalition of countries, cities, businesses, and institutions is committing to net-zero emissions. More than 70 countries, including the world’s largest polluters such as China, the United States, and the European Union, have set net-zero targets, covering roughly 76% of global emissions.

Over 3,000 businesses and financial institutions are working with the Science-Based Targets initiative to cut their emissions in line with climate science. More than 1,000 cities, 1,000 educational institutions, and 400 financial institutions have joined the Race to Zero, pledging to take bold, immediate action to halve emissions by 2030.

The energy sector currently accounts for about 75% of global greenhouse gas emissions, which means it holds the key to avoiding the worst impacts of climate change. Replacing fossil fuel-based power generation with renewable sources, such as wind and solar, is essential. However, this shift also hinges on expanding energy storage capacity and electrifying transportation.

And that’s where lithium-ion batteries come in - enabling the energy transition by powering both clean mobility and renewable energy systems.

-

The Global Phase-Out of Fossil-Fueled Vehicles

The shift away from fossil fuel-powered vehicles is accelerating. Many countries are announcing plans to phase out gasoline and diesel cars and buses soon.

Several nations and cities have already set future dates for banning the sale of internal combustion engine vehicles, and some have gone even further, targeting other types of fossil-fueled transport, such as ships and heavy-duty lorries.

Adding to this momentum, more than 100 countries, cities, financial institutions, and multinational companies - including major automakers like Ford, General Motors, and Volvo Cars - have signed the Glasgow Declaration on Zero-Emission Cars and Vans. The goal is to end sales of internal combustion engine vehicles by 2035 in leading markets and by 2040 worldwide.

-

The Inflation Reduction Act – Powering U.S. Lithium Demand

The Inflation Reduction Act (IRA) includes several key provisions that directly support the lithium industry and the broader EV market in the United States:

Clean Vehicle Credit: Battery components must meet strict sourcing requirements to qualify for the full $7,500 EV tax credit. A significant share of materials must be sourced or processed in the U.S. or by trusted trade partners, which encourages domestic supply chain growth and reduces reliance on foreign minerals.

Programs Supporting Domestic Supply Chain Growth:

- $3 billion for the Department of Energy’s Advanced Technology Vehicle Manufacturing Loan Program, supporting clean vehicle and component production in the U.S.

- $2 billion for Domestic Manufacturing Conversion Grants to help retool existing facilities for EV production.

- The Advanced Manufacturing Production Credit offers incentives for producing and selling U.S.-made clean energy components, including batteries and critical minerals like lithium.

Real-World Impact

According to the White House, nearly $85 billion has been invested in U.S. electric vehicles (EVs), battery production, and charging infrastructure since the passage of the IRA, while EV sales have tripled. This surge creates a strong market environment for lithium extraction companies and increases demand for domestically sourced raw materials.

The IRA sets the stage for U.S. battery manufacturing capacity to grow from 119 GWh today to 440 GWh by 2025, and more than 1,000 GWh by 2030 – a 9x increase. As more battery manufacturers enter the market, competition for local lithium supply will intensify, creating significant opportunities for offtake agreements and accelerating demand for U.S.-produced lithium compounds.

-

The European Critical Raw Materials Act – Securing Strategic Supply

In March 2023, the European Union introduced the Critical Raw Materials Action Plan to strengthen the resilience and sustainability of its strategic mineral supply chains, including lithium.

The regulation sets clear 2030 benchmarks for domestic capacity and diversification across the EU’s strategic raw materials supply chain:

- At least 10% of annual consumption is sourced from domestic extraction

- At least 40% processed within the EU.

- At least 15% supplied through recycling

- No more than 65% of any given strategic material’s processing from a single third country

Streamlining & Simplifying for Faster Progress

The Act reduces administrative burdens and simplifies permitting procedures for projects involving critical raw materials. It also supports the uptake of breakthrough technologies across the supply chain.

While the EU acknowledges it won’t be fully self-sufficient in supplying these materials, it is focused on diversifying the global supply, improving resilience, and promoting sustainable development worldwide.

A Global, Strategic Approach

To ensure a stable and secure supply of critical materials like lithium, the EU aims to:

- Strengthen international partnerships with trusted countries

- Promote investment stability and legal certainty for critical raw materials projects

- Monitor supply chains and build long-term resilience

- Advance circularity and sustainability across value chains

The initiative also includes creating a Raw Materials Academy to promote relevant skills and partnerships that support local economic development in resource-rich regions. These partnerships foster mutual benefits through strategic, sustainable collaboration.

-

The EU Battery Regulation – Driving Sustainability in Battery Supply Chains

The new EU Battery Regulation, which came into effect on 18 February 2024, introduced a major regulatory shift. This landmark framework is designed to promote more sustainable, circular, and safe battery production and use across the EU.

However, not all provisions take effect immediately. The regulation is being rolled out in phases over the coming years, with stricter standards being introduced progressively. Specific areas of implementation are still being defined.

Compliance and Enforcement

One key requirement is that all battery manufacturers and importers selling in the EU must comply with these new standards. Depending on enforcement policies in each EU member state, non-compliance could lead to significant consequences, including market restrictions or product withdrawals.

Carbon Footprint Disclosure by 2025

A cornerstone of the regulation is the mandatory disclosure of a battery's carbon footprint starting 18 February 2025. This includes the full life cycle - from raw material extraction and processing to manufacturing and end-of-life recycling. (The use phase is currently excluded.)

The goal is to increase transparency and incentivize the production of batteries with a lower environmental impact.

Supporting the Green Transition

Batteries are central to the EU's green transition, enabling clean mobility and supporting the goal of climate neutrality by 2050. To align with these ambitions, the regulation will gradually introduce:

- Carbon footprint declarations

- Performance classification schemes

- Maximum carbon footprint thresholds

Starting in 2025, these rules will apply to EV batteries, batteries for light vehicles (such assuch as e-bikes and scooters), and rechargeable industrial batteries.

The EU Battery Regulation marks a significant step toward reducing batteries' environmental footprint and ensuring they contribute to the shift to sustainable mobility and climate neutrality.

Industry Outlook and Predictions

As we look to the future, several key trends and predictions point to a dynamic and promising outlook for the lithium market. Demand for lithium is expected to keep rising steadily, driven mainly by the electric vehicle (EV) and battery storage sectors.

The global shift toward clean energy, combined with growing adoption of electric vehicles (EVs) in response to climate concerns and government incentives, continues to fuel this surge. Lithium is set to remain a critical enabler of the green energy transition, powering innovations in transportation, energy storage, and beyond.

Diverse Technologies for Lithium Extraction

The world of lithium extraction is evolving fast, as new technologies emerge to meet rising global demand for this critical mineral. Here’s a quick overview of the key extraction methods currently in use:

- Traditional Hard Rock Mining: This method involves mining spodumene ore, which is then crushed and processed to extract lithium. It’s well-established but energy-intensive and can have significant environmental impacts.

- Brine Evaporation Ponds: This approach, commonly used in South America, involves pumping lithium-rich brine to the surface and allowing it to evaporate in large ponds. It’s more cost-effective than hard rock mining, but it requires vast land areas and long production timelines.

- Direct Lithium Extraction (DLE): DLE is a newer, more sustainable method that extracts lithium directly from brine using technologies like ion exchange and adsorption. It’s faster, uses less land and water, and leaves a smaller environmental footprint compared to evaporation ponds.

- Lithium Extraction from Oilfield Wastewater and Geothermal Brine: Companies like Lithium Harvest are leading the way in extracting lithium from produced water in oilfields and geothermal brine. This breakthrough approach turns waste and byproducts into a valuable resource, highlighting a sustainable and cost-effective alternative to traditional methods.

Each method has its strengths and limitations. As lithium demand continues to rise, advancing more efficient, scalable, and environmentally friendly extraction technologies will be key to shaping the industry's future.

Technological Benchmark

Lithium Harvest Solution |

DLE from Brine |

Solar Evaporation Brine Extraction |

Hard Rock Mining |

|

|---|---|---|---|---|

| Feedstock | Produced water / geothermal brine | Continental brine | Continental brine | Rock / spodumene |

| Project implementation time | 12-15 months | 5-7 years | 13-15 years | 8-10 years |

| Lithium carbonate production time | 2 hours | 2 hours | 2-3 years | 3-6 months |

| Lithium yield | >95% | 80-95% | 20-40% | 6-7% |

| Average footprint per 1,000 mt LCE | 1.4 acres | 1.4 acres | 65 acres | 115 acres |

| System design | Modular and mobile | Mobile / stationary | Stationary | Stationary |

| Environmental impact | Minimal | Minimal | Soil- and water contamination | Soil- and water contamination |

| Water consumption per 1,000 mt LCE | 20 million gallons | 80 million gallons | 550 million gallons | 250 million gallons |

| CO₂ footprint per 1,000 mt LCE | Neutral | 1.5 million kg | 5 million kg | 15 million kg |

Lithium Harvest Solution

DLE from Brine

Solar Evaporation Brine Extraction

Hard Rock Mining

The Urgent Need for Sustainable Lithium Extraction

As the world accelerates its shift toward renewable energy and electric vehicles, lithium demand continues to surge. But with that growth comes a critical challenge: the urgent need for more sustainable extraction methods. Meeting demand is only part of the equation — doing it responsibly is just as essential.

The Environmental Cost of Traditional Mining

Conventional lithium mining methods like open-pit mining and brine evaporation come with significant environmental downsides — from water depletion and soil degradation to high carbon emissions. These practices can have a severe impact on local ecosystems and communities, particularly in water-scarce regions.

In response, the industry is shifting toward more sustainable solutions. Companies like Lithium Harvest are pioneering low-impact technologies, including lithium extraction from oilfield wastewater and geothermal brine. These methods repurpose industrial waste and dramatically reduce environmental impact compared to traditional mining.

ESG Momentum and Market Shifts

The drive for sustainable lithium isn’t just coming from regulators or environmental groups — it’s increasingly a business imperative. EV and tech companies are prioritizing responsibly sourced lithium to meet their environmental, social, and governance (ESG) goals. This shift is already influencing procurement strategies and reshaping supply chains.

According to Benchmark Minerals, demand for sustainable lithium is set to surge, as more industries seek ESG-aligned materials to future-proof their operations.

Future Projections – A Clear Call for Innovation

Projections show that without scalable, sustainable solutions, the global lithium market could face a supply shortfall of up to 10 million metric tons of lithium carbonate equivalent (LCE) between 2025 and 2034 under high-demand scenarios. Even under more conservative models, the gap could be 2.5x larger by 2034 than it is today.

To close this gap and responsibly meet demand, the industry must accelerate the adoption of next-generation extraction technologies. Companies that lead on sustainability are not only helping the planet but also building a long-term competitive advantage in a rapidly evolving market.

Lithium

You may also be interested in: