How EV Development is Driving Lithium Demand

Energizing the future - unpacking the vital link between electric vehicles and lithium innovation.

Introduction

As countries worldwide commit to reducing carbon emissions, electric vehicles (EVs) have become a central part of the transition toward a cleaner, more sustainable future. However, beneath the stylish designs and nearly silent motors lies the unsung champion of this movement: lithium.

This critical element isn’t just powering the EV revolution - it’s driving breakthroughs in battery technology and sustainable extraction practices.

In this blog post, we’ll explore how the rise of electric vehicles is fueling global lithium demand. From the mine to the motorway, we’ll uncover how the push for electrification is reshaping industries, economies, and environmental strategies worldwide.

Table of contents:

- More Vehicles on the Road

- EV Skeptinism? Exponential Growth in EV Sales

- Rapid Gain in Market Share by Electric Vehicles

- EV Sales Share by Country

- Electrified Mobility - Displacing Conventional Vehicles

- Are EV Batteries Getting Bigger?

- Reevaluating Lithium Demand Projections?

- Lithium - The Cornerstone of EV Growth

- Looking Ahead - Lithium and the EV Future

More Vehicles on the Road

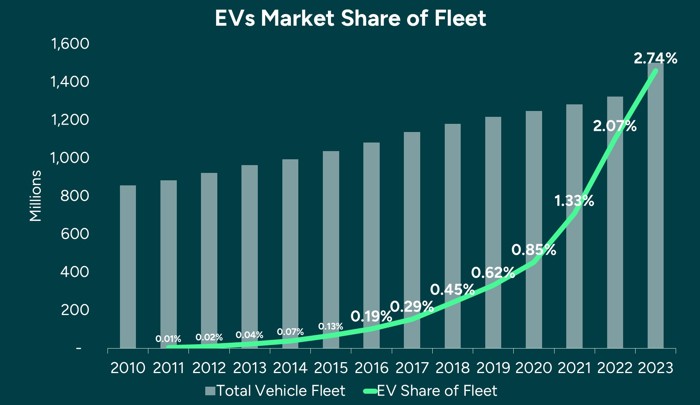

Over the past decade, the number of internal combustion engine (ICE) vehicles and electric vehicles (EVs) on the road has dramatically risen. In 2010, there were around 857.7 million ICE vehicles worldwide. By 2023, that number had grown to more than 1.46 billion, highlighting the continued demand for personal and commercial transport.

Several factors are behind this growth. Economic expansion in emerging markets means more people can afford vehicles. Urbanization has also played a significant role, as city dwellers seek out convenient ways to get around. On top of that, the surge in global consumer goods consumption has driven up demand for commercial vehicles to keep deliveries moving.

But here’s where the fundamental shift is happening: EV adoption. Back in 2011, there were just 60,000 EVs on the road. By 2023, that number had soared to over 41 million. This explosive growth reflects more than just changing tastes - it’s the result of major leaps in EV technology, rising environmental awareness, and government policies supporting cleaner transportation. By 2024, nearly 59 million EVs are expected to be on the road, pointing to an even steeper growth curve ahead.

EV Skepticism? Think Again - Exponential Growth in EV Sales

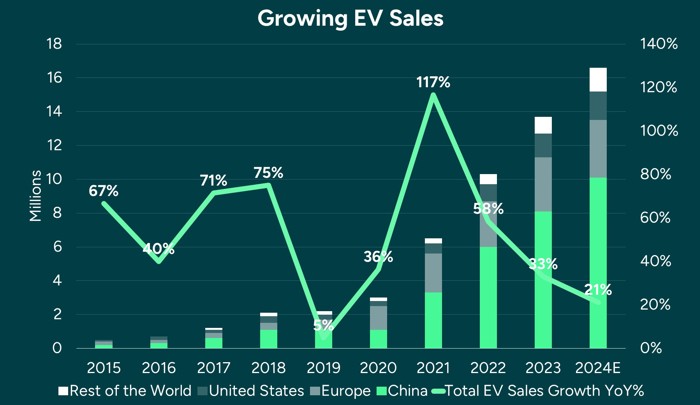

The electric vehicle (EV) market is in the fast lane. In 2023 alone, nearly 14 million EVs were sold worldwide - a 33% jump from 2022. And the momentum isn’t slowing down. In 2024, sales are expected to reach around 17 million units, solidifying EVs as a dominant force in the global automotive industry. To put that in perspective, global EV sales have more than quintupled from 2020 to 2024. Over the past decade, we’ve gone from just 230,000 EVs sold in 2013 to 17 million projected for 2024 - that’s a staggering 7,000% increase.

Regional EV sales growth highlights

EV adoption is picking up speed across the board, with significant year-over-year growth from 2022 to 2023 in key regions:

- China: Sales jumped from 6 million to over 8 million - a 35% boost, fueled by strong government backing and a fiercely competitive EV manufacturing scene.

- Europe: Up from 2.7 million to 3.2 million, Europe saw 18.5% growth, driven by strict emissions rules and attractive incentives.

- United States: Sales rose from 1 million to 1.4 million - a 40% increase, helped by federal tax credits and growing automaker commitments.

- Other Regions: This diverse category saw the highest percentage jump, from 600,000 to over 1 million units, a 66.6% surge that shows EV adoption is truly going global.

Still, skepticism lingers. Some people worry about battery life, charging infrastructure, and the upfront cost of EVs. But here’s the good news: tech is catching up fast. Batteries are getting more efficient, charging networks are expanding, and production costs are dropping. That means EVs are becoming more affordable and practical for more people.

The key drivers behind the EV boom

- Sustained growth: From 3 million EVs sold in 2020 to nearly 17 million expected in 2024 - that’s more than a fivefold increase in just four years.

- Government incentives: Tax breaks, purchase subsidies, and investments in charging infrastructure are making EVs more appealing worldwide.

- Better tech: Innovations in battery chemistry and faster charging are addressing range anxiety and long recharge times.

- Environmental awareness: As climate change becomes a top concern, more people are switching to clean, electric transportation.

- Automaker confidence: Major carmakers are investing billions in new EV models and expanding production capacity.

This is more than a trend - it’s a full-blown transformation of the auto industry. And lithium is the element powering it forward.

Rapid Gain in Market Share by Electric Vehicles

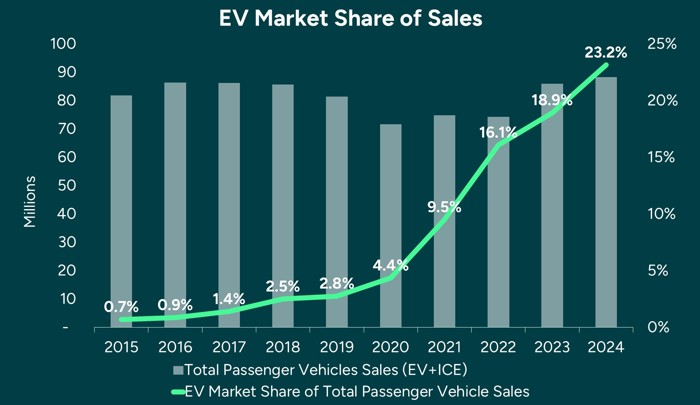

Electric vehicles (EVs) are quickly capturing a larger share of the global auto market, demonstrating just how quickly consumer preferences are shifting toward more sustainable transportation. In 2020, EVs accounted for just 4.4% of global passenger vehicle sales. By 2023, that number had jumped to 19% - and it's expected to hit over 23% in 2024. That kind of growth isn't just impressive - it signals a fundamental shift in how people think about cars.

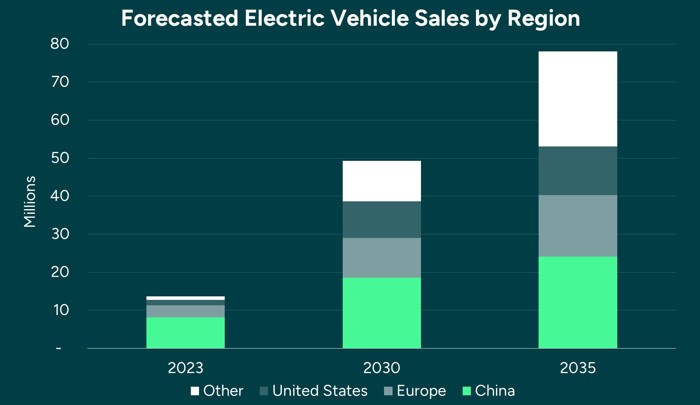

Where we're headed

In the U.S., S&P Global Mobility projects that EVs could make up 40% of passenger car sales by 2030. Some forecasts are even more bullish, predicting EVs could pass 50% in regions with strong government support for clean transportation. Globally, EVs are expected to account for more than half of all new car sales by 2035. By then, the total EV fleet could swell to around 585 million - that's a twelvefold increase from today, with an average annual growth rate of 24% from 2023 to 2035.

The numbers behind the boom

- 2024 EV sales forecast: ~17 million units

- 2024 market share: EVs are projected to make up over 23% of global car sales

Automakers are all in

By 2035, global EV sales are expected to reach nearly 80 million units per year, and 50% of all cars sold worldwide will be electric. That's largely thanks to bold commitments from over 20 major carmakers - the same ones responsible for 90% of all global vehicle sales in 2023. These automakers have set clear goals to electrify their lineups, helping to accelerate the industry's shift to electric vehicles.

What's remarkable is that EVs have maintained this momentum despite global supply chain issues and shifting post-pandemic consumer behavior. While the overall auto market has experienced ups and downs, the EV sector just keeps growing - and fast.

North America – EV Sales Share

In North America, the shift to electric vehicles is picking up speed, and quickly. Stricter emissions regulations, rising consumer awareness, and significant investments in EV infrastructure are all fueling the transition. Both the U.S. and Canada are seeing a surge in EV adoption, thanks in large part to federal incentives like tax credits and grants for buyers and manufacturers.

In 2023, EVs accounted for 9% of all new vehicle sales in North America. That number’s expected to hit 12% in 2024 and jump to 39% by 2030. What’s behind the momentum? A big part of it is the bold commitments from American automakers to electrify their fleets. As those plans roll out, we’ll see fewer combustion engines on the road - and a much cleaner, quieter ride for everyone.

Europe – EV Sales Share

Europe is leading the global charge in electrifying transportation. In 2023, EVs made up 21% of all new car sales - and that’s expected to rise to 25% in 2024 and hit an impressive 62% by 2030. Countries like Norway, Sweden, and the Netherlands are already way ahead, showing some of the highest EV adoption rates in the world.

What’s driving it? Aggressive carbon reduction targets. The European Union has made electrification a key part of its climate strategy, backing it up with generous consumer subsidies and significant investments in charging infrastructure. European automakers are also stepping up, driven by strict emissions rules and the EU’s ambition to become climate-neutral by 2050.

China – EV Sales Share

China is the world’s largest EV market - and it’s not even close. Strong government policies, large subsidies, and strict quotas for automakers have supercharged EV adoption nationwide. In 2023, EVs made up 32% of new car sales. That number is expected to hit 40% in 2024 and soar to 62% by 2030.

This growth isn’t accidental. China’s push for “new energy vehicles” is part of a broader strategy to cut urban pollution, reduce dependence on imported oil, and strengthen domestic tech capabilities. Add in the country’s massive manufacturing power and near-total control over key battery materials like lithium, and it’s clear why China plays such a dominant role in the global EV landscape.

Electrified Mobility - Displacing Conventional Vehicles

The shift from conventional vehicles to electric vehicles (EVs) is one of the most important trends shaping global transportation. It’s being driven by a combination of environmental urgency, rapid tech advancements, and strong government support.

We’re seeing this transition take off across North America, Europe, and China, each powered by different combinations of regulation, consumer demand, and economic strategy. The rising share of EV sales in these regions isn’t just cutting carbon emissions - it’s laying the foundation for smarter, cleaner transportation systems.

As more governments and automakers double down on electrification, they’re not just curbing greenhouse gases. They’re also fueling breakthroughs in battery technology, vehicle design, and sustainable supply chains, including lithium extraction.

This global EV push is essential to meeting climate targets. It’s also creating huge opportunities across the EV ecosystem, especially for companies that are pioneering sustainable lithium production and battery innovation.

Are EV Batteries Getting Bigger?

As the EV market grows, battery technology is evolving fast. We’re seeing bigger, more efficient batteries that deliver longer range, better performance, and improved durability. But with those advancements comes a significant side effect - increased demand for lithium.

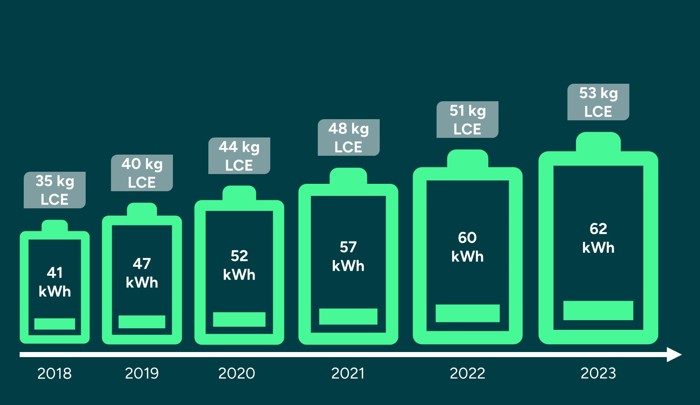

Bigger batteries, bigger lithium demand

The average size of lithium-ion battery packs has been increasing by about 10% per year, rising from around 40 kWh to over 60 kWh in just a few years. That means each new EV rolling off the line requires more lithium carbonate equivalent (LCE) than ever before. In fact, lithium use per vehicle battery increased 1.5 times by 2023. Depending on the vehicle, battery sizes now range from 30 kWh in compact models to 200 kWh in heavy-duty electric trucks.

Why lithium quality matters

As batteries get bigger, the need for high-quality lithium becomes even more critical. Purity directly impacts battery performance, charging speed, and overall lifespan. Consumers expect long-lasting EVs that deliver on range and reliability, and that starts with the quality of the lithium inside.

This shift toward larger, high-performance batteries is reshaping the lithium supply chain. It’s not just about producing more lithium - it’s about making it smarter, cleaner, and more sustainable.

Reevaluating Lithium Demand Projections?

As EV batteries get bigger and pack more power, lithium demand is climbing faster than many predicted. This trend raises some big questions:

Are analysts falling behind?

Some market forecasts still underestimate how much bigger battery sizes are driving up lithium demand. It’s not just about more EVs on the road - it’s about each EV needing more lithium than before.

The need for smarter supply

This demand surge isn’t just a challenge - it’s a call to action. To keep up without harming the planet, we need sustainable methods for extracting lithium. That’s where companies focused on environmentally responsible solutions come in. They’re not just meeting demand - they’re shaping a cleaner, more resilient future.

So, is this rising demand a looming problem - or a golden opportunity for innovation?

It might be both. The real opportunity lies in scaling up smart:

- Innovating extraction techniques that reduce water use, emissions, and land impact

- Investing in closed-loop recycling systems

- Diversifying supply through unconventional sources like geothermal brines and oilfield wastewater

If we do it right, the lithium boom won’t just fuel EVs - it’ll accelerate sustainability across the board.

Lithium - The Cornerstone of EV Growth

Lithium is the backbone of modern electric vehicle (EV) technology. Thanks to its high electrochemical potential and lightweight nature, it’s the ideal material for lithium-ion batteries, which are the preferred choice for EVs due to their high energy density, long lifespan, and ability to handle numerous charge and discharge cycles.

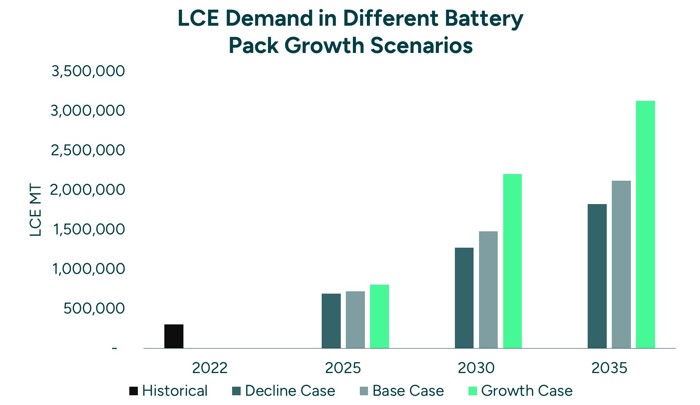

As more people shift to electric vehicles and governments double down on climate commitments, lithium demand is rising fast. According to BloombergNEF, as battery sizes increase to meet consumer demand for longer range, lithium demand - measured in Lithium Carbonate Equivalent (LCE) - will surge under all projected scenarios:

- Base case: If EV adoption grows steadily without breakthroughs, LCE demand is expected to rise 84% between 2025 and 2030, and more than 195% by 2035.

- Growth case: If EV uptake accelerates and battery sizes continue to expand, demand could increase by 174% by 2030 and skyrocket by 289% by 2035 - nearly 50% higher than the base case.

- Decline case: Even in a slower adoption scenario, demand still grows 84% by 2030 and 164% by 2035.

Note: These projections reflect combined demand in China, the U.S., and Europe.

What’s clear across every scenario is that as EVs become more capable and consumer expectations rise, the pressure on the lithium supply will only intensify. Larger battery packs, longer ranges, and better performance all translate into more lithium per vehicle, making the race to scale up sustainable, high-quality lithium production more urgent than ever.

Want to See Why Lithium Demand Is Accelerating?

Watch this short CERAWeek 2025 clip where our CEO, Sune Mathiesen, explains how electric vehicles are reshaping global lithium demand - and what comes next.

Looking Ahead - Lithium and the EV Future

As we enter the 21st century, the link between electric vehicle (EV) growth and lithium demand will only become more critical. Global initiatives are ramping up the shift toward renewables and lower emissions, and EVs are leading the charge. Lithium, as a core battery material, is at the center of it all.

Simply put, the future of EVs and lithium is tightly connected. As the world continues to electrify transportation, lithium demand will rise alongside it, driven by improved battery technology, evolving regulations, and shifting global markets. But there’s a catch: keeping this momentum going will depend on how well we adapt.

That means investing in more innovative lithium sourcing, sustainable extraction methods, and better recycling practices. These innovations are not only helpful but essential if we want to support the EV boom without trading one environmental problem for another.

The road ahead is electric - and with the right approach, it can also be sustainable.

-

Technological advancements in EVs

The future of EVs will likely be shaped by significant advancements in battery tech that boost efficiency, increase capacity, and slash charging times. As automakers pour resources into next-gen batteries with higher energy density and quicker recharge rates, lithium demand might shift, not just in volume, but in how it's extracted and processed.

If these innovations improve the use of lithium or require new lithium-based compounds, the entire supply chain may evolve. This could lead to cleaner, smarter, and more localized extraction techniques, helping us obtain the lithium we need without sacrificing sustainability.

-

Increasing EV adoption rates

EV adoption is expected to accelerate worldwide, driven by stricter emissions regulations, declining battery costs, and increasing consumer awareness of sustainability. As more people switch from combustion engines to electric vehicles, lithium demand will continue to climb.

If EVs make up 50% of all vehicle sales by 2035 - or even more - the surge in lithium demand could be exponential. That kind of growth highlights the urgent need for lithium extraction methods that can scale quickly and remain sustainable.

-

Policy drives progress

Government policies and regulations play a huge role in shaping the future of EVs - and the lithium needed to power them. Incentives for EV purchases, funding for charging infrastructure, and restrictions on fossil fuel use all help speed up the shift to electric mobility.

But it’s not just about EVs. Environmental rules around mining are also pushing the lithium industry to clean up its act, favoring more sustainable extraction methods like lithium recovery from oilfield brine. These approaches reduce the environmental footprint while supporting the growing need for critical minerals.

In short, smart policy isn’t just accelerating EV adoption - it’s laying the groundwork for a cleaner, more stable, and more sustainable lithium supply chain.

-

Global supply chain dynamics

Lithium isn’t just a resource - it’s a strategic advantage. As global demand surges, securing a stable, ethical lithium supply has become a top priority for governments and industries alike.

This race for resources could reshape alliances - or spark new tensions over lithium-rich territories. Countries are already working to secure supply deals, diversify sources, and invest in domestic production to reduce their reliance on a handful of producers.

At the same time, there’s growing momentum around lithium recycling. By recovering valuable materials from used batteries, we can ease the pressure on mining, reduce environmental impact, and create a more circular and resilient supply chain. Recycling won’t replace extraction entirely, but it’s a powerful piece of the puzzle.

Energy Transition

You may also be interested in: